Realize your homeownership aspirations with a specialized home loan designed to meet your unique needs. These loans often provide more flexibility than traditional lending paths, making them an ideal solution for individuals seeking a tailored approach to home financing.

A private lender works directly with you to understand your financial history, allowing them to design a loan plan that improves your chances of approval.

With a private home loan, you can frequently access financing for properties that may not qualify for conventional finances. This extends the selection of dream homes within your reach, regardless of your purchasing history.

Don't let traditional lending barriers hold you back. Explore the opportunities of a private Private Home Loan home loan and obtain the home of your dreams.

Top Provider of Private Home Loans in Australia

If you're seeking a flexible home loan solution that meets your unique needs, look no further than [Company Name]. As Australia's top-ranked provider of private home loans, we offer a wide range of financing options to help you achieve your property goals. Our team of experienced loan specialists is driven to providing superior customer service and guiding you through every step of the process with clarity. Whether you're a first-time homebuyer or an experienced investor, we have a option that's right for you.

- Our private home loans offer attractive interest rates and terms.

- Fast approval process to get you moving quickly.

- Expert guidance every step of the way.

Conquer Bad Credit and Get Approved for a Home Loan

Owning a house is a dream for many, but bad credit can appear to be an insurmountable obstacle. The good news is that it's not always the end of the road. While a low credit score might make challenges, there are still steps you can take to strengthen your financial picture and get approved for a home loan.

- Launch by reviewing your credit report and pinpointing any errors or areas that need attention.

- Enhance your credit score over time by fulfilling payments on time, decreasing your credit utilization ratio, and avoiding opening too much new credit.

- Explore different loan options, such as FHA loans or programs created for borrowers with bad credit. These choices often have more lenient requirements than conventional loans.

With a bit of dedication, you can surpass bad credit and achieve your dream of homeownership. Remember, don't allow a low credit score discourage you from pursuing this important financial goal.

Unconventional Lending for Private Home Loans in Australia

Securing a residential finance can be challenging in Australia's landscape. A growing number of Australians are turning to private lending platforms for their private home loans. These providers offer flexible loan terms and parameters, often meeting the needs of borrowers who may not qualify for mainstream financing.

- Factors driving borrowers to opt for non-bank lending include quicker turnaround, relaxed standards and specialist expertise in particular asset classes.

- Nevertheless, it's essential to diligently investigate any non-bank lender before signing up for a loan. Compare interest rates, fees, mortgage structures and the lender's track record.

By understanding the scene of non-bank lending, Australian borrowers can uncover financing possibilities that may suit their specific needs.

Receive Your Private Home Loan Quickly!

Dreaming of owning your perfect home? Don't let the mortgage process delay your goal. With our fast approval process, you can obtain funding for your private dwelling in minimal time. We understand the importance of a timely home procurement. Our dedicated team is committed to providing you with streamlined service every step of the way.

- Advantage 1

- Advantage 2

- Advantage 3

Accessing Homeownership with Private Mortgages: A Comprehensive Guide

Dreaming of owning your personal home but facing challenges with traditional financing? Investigate the world of private home loans, an alternative mortgage option that can aid you achieve your real estate goals. Private lenders, unlike conventional banks, offer adjustable lending terms and considerations that may be more fitting for individual financial situations. From self-employed individuals to those with unconventional credit histories, private home loans can provide a pathway to homebuying.

To knowledge of the system, benefits, and potential challenges, you can determine if a private home loan is the right option for your circumstances.

- Learn about the different types of private home loans available.

- Assess interest rates, terms, and fees from various lenders.

- Collect the necessary documentation to support your application.

Mara Wilson Then & Now!

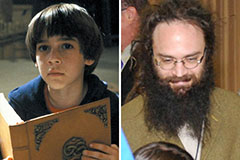

Mara Wilson Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!